springfield mo sales tax rate 2021

Get rates tables What is the sales tax rate in Springfield Missouri. Sales tax rates change at the start of the quarter never in the middle of a quarter and can only be changed by a vote of the people at that location.

Use Tax Web Page City Of Columbia Missouri

The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax.

. Find your Missouri combined state and local tax rate. The County sales tax rate is. Over the past year there have been 97 local sales tax rate changes in Missouri.

Statewide salesuse tax rates for the period beginning July 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. View detailed information about property 1505 N Stephens Ave Springfield IL 62702 including listing details property photos open house information school and.

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Missouri sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Revenues for 2021-2022 is 330643167. Therefore the 24 income tax rate will remain in effect for the City of Springfield until at least 2032. Ad Access Tax Forms.

Our voters then approved a renewal of this income tax rate for 10 more years on the May 2021 ballot. Did South Dakota v. 102021 - 122021 - PDF.

The base state sales tax rate in Missouri is 423. Benchmark Cities No City Sales Tax Contact Us David Holtmann Director of Finance Email Busch Municipal Building 840 Boonville Ave. When the sales tax rate changes at your location be sure to generate and print new rate cards as needed.

The Springfield sales tax rate is. The top tax bracket is 53 which applies to employees who make more than 858500 annually. 2021 Missouri State Sales Tax Rates The list below details the localities in Missouri with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

The Branson sales tax rate is 2. 17 rows Springfield compares or benchmarks itself to other cities in our size and region. This is the total of state county and city sales tax rates.

Personalized vertical bar necklace. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. An alternative sales tax rate of 91 applies in the tax region Republic which appertains to zip codes 65802 and 65807.

Select a year for the tax rates you need. Tax amount varies by county. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. The state sales tax rate in Missouri is 4225. Mogov State of Missouri.

Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101. With local taxes the total sales tax rate is between 4225 and 10350. Enter your street address and city or zip code to view the sales and use tax rate information for your address.

65801 65803 65804 65805 65806 65808 65809 65810 65814 65817 65890 65897 65898 and 65899. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The income tax rates for the 2021 tax year which you file in 2022 range from 0 to 54.

The minimum combined 2022 sales tax rate for Springfield Missouri is. You pay tax on the sale price of the unit less any trade-in or rebate. Statewide salesuse tax rates for the period beginning October 2021.

The County sales tax rate is 213. Missouri has recent rate changes Wed Jul 01 2020. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

This page will be updated monthly as new sales tax rates are released. The City of Springfield income tax rate increased from 2 to 24 effective July 1 2017. Avalara provides supported pre-built integration.

2021 State Sales Tax Rates California has the highest state-level sales tax rate at 725 percent. Primary revenues include local tax Proposition C sales tax and State of Missouri funding including Basic Formula and Classroom Trust funds. Indicates required field.

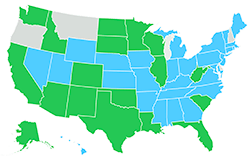

Did South Dakota v. The benchmarks below are used to compare our taxing levels to these other cities. The lowest non-zero state-level sales tax is in Colorado which has a rate of 29 percent.

Rates for employers participating in the Shared Work Program could range from 00 to 90 also not including maximum rate surcharge andor contribution rate adjustment. Select the Missouri city from the list of popular cities below to see its current sales tax rate. Rates could range from 00 to 60 not including maximum rate surcharge andor contribution rate adjustment.

What is the sales tax rate in Branson Missouri. 2 Four states tie for the second-highest statewide rate at 7 percent. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

In 2014 the Missouri legislature voted to cut income taxes in the state for the first time in almost 100 years. John Jungmann Superintendent. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

The tax rate hearing will be held on August 17. This is the total of state county and city sales tax rates. For 20212022 other -.

The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. The Missouri sales tax rate is currently. Total Sales Tax Rates.

SalesUse Tax Rate Tables. Find Sales and Use Tax Rates. Complete Edit or Print Tax Forms Instantly.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355 Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The minimum combined 2022 sales tax rate for Branson Missouri is 1036. Click here for a listing of sales tax rate changes in the current quarter.

Starting with tax year 2014 the top tax rate started falling from 6 to 54 over the course of five years. Mogov State of Missouri. 072021 - 092021 - PDF.

State of Missouri Navigation. The Springfield Missouri sales tax rate of 81 applies to the following fourteen zip codes. Its a progressive income tax meaning the more money your employees make the higher the income tax.

Springfield MO 65802. Greene County Taxing Districts Pay Taxes Statements and Receipts Collector of Revenue Allen Icet 940 N Boonville Ave Room 107 Springfield MO 65802 417 868-4036 collectorhelpgreenecountymogov Menu Collector Home Resources Q and A Forms of Payment Accepted Real Estate Taxes Personal Property Taxes Tax Sale Vehicle Licenses. Indiana Mississippi Rhode Island and Tennessee.

The Missouri sales tax rate is currently 423. Counties in Illinois collect an average.

Missouri Sales Tax Guide For Businesses

Use Tax Web Page City Of Columbia Missouri

Nebraska Sales Tax Rates By City County 2022

Taxes Springfield Regional Economic Partnership

Highest Gas Tax In The U S By State 2022 Statista

Missouri Sales Tax Small Business Guide Truic

Missouri Sales Tax Rates By City County 2022

Michigan Sales Tax Guide For Businesses

Financial Reports Springfield Mo Official Website

Sales Tax On Grocery Items Taxjar

Missouri Income Tax Rate And Brackets H R Block